July’s Eilers-Fantini report saw Evolution reclaim its lead in the US supplier charts as IGT fell just short of securing pole position for consecutive months.

IGT did, however, manage to remain at the top of the supplier pile in the Canada report, striding ahead of Evolution, Pragmatic Play and Light & Wonder as Eilers & Krejcik Gaming’s research continues to expand across North America.

US performance

Continuing a long-standing trend, IGT’s Cash Eruption slot finished first in the top games by GGR charts for the US, claiming a sizable 3.19 per cent of GGR share (June: 3.02 per cent).

Yet, the supplier’s Blackjack table game, which had previously secured second place for four consecutive months, could only claim third place in July’s edition.

This was due to Anaxi’s Buffalo slot climbing from third place into second, claiming 1.65 per cent GGR share (June: 1.68 per cent) compared to Blackjack’s 1.51 per cent (June: 1.9 per cent).

A new ranking from AGS shot straight into the top five games by GGR this month as 3x Ultra Diamond secured fourth place with 1.27 per cent GGR share. This was then followed by Evolution’s Live Dealer Roulette, which kept the same fifth place finish as last month with a 1.08 per cent share.

From the top 25 games per GGR, 16 were slot titles, four were table games, five were live casino titles and one video poker game was included.

July’s top games overall charts witnessed another blend of stable performers and new rankings make-up the top five, as Cash Eruption secured first place for another consecutive month while a new ranking from Games Global, Fish Em Up, claimed second place.

Capital Gains, a slot from AGS, rose from fourth to third, IGT’s Blackjack slid down once again to claim fourth place after having finished second consistently in previous months.

Another new ranking rounded out the top five as 3x Ultra Diamond from AGS proved itself as a top-performer once again to clinch the fifth place finish.

Live Dealer Lightning Roulette from Evolution, Games Global’s Gold Blitz Extreme, Internal’s Craps, Secrets of the Forest by High 5 Games and 88 Fortunes from Light & Wonder made up the rest of the top ten, in that order.

Looking at the slot-specific charts, Cash Eruption secured first place for another consecutive month while Fish Em Up claimed second place in this chart too.

Capital Gains dropped from its second place finish last month down to third place, 3x Ultra Diamond took fourth place and Gold Blitz Extreme climbed 19 places to take fifth place (June: 24th).

Within the top 25 slots, 13 suppliers were represented as High 5 Games, Light & Wonder, Reel Play, Aristocrat, Inspired, Gamecode, Everi, Evolution, Bragg Gaming Group and White Hat Studios each placed at least once.

In another sign of dominance for AGS’ 3x Ultra Diamond slot, the game came first in the US charts for new games overall, beating Gold Blitz Extreme to the post, which itself climbed from 10th place last month to finish second.

In corresponding order, Rakin Bacon Odyssey from AGS, Mr Pigg E Bank – a new ranking from Games Global, and Cashpile from Gamecode (June: third) made up the rest of the top five.

Last month’s highest-ranking new game, Gamecode’s Boom Boom Boom, was nowhere to be found in the top 25 for July, while June’s second placed Dark Waters Power Combo from Games Global fell out of the top ten to place 12th.

For yet another month, each game that appeared in the top 25 new game rankings was a slot title, proving the vertical’s dominance in the US.

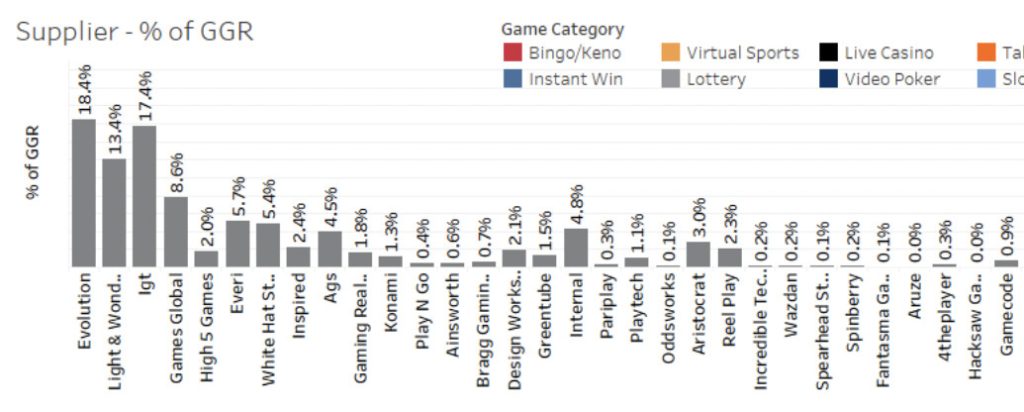

Evolution, as aforementioned, reclaimed its usual position atop the supplier charts with 18.4 per cent share of GGR, a 0.5 per cent increase from the 17.9 per cent it gained in June.

IGT was knocked from its short-lived perch as its share of GGR dropped by 0.9 per cent from June’s 18.3 to 17.4 per cent. Light & Wonder claimed its expected third place with 13.4 per cent (June: 13.9 per cent).

Again, the only supplier to come slightly close to the top three was Games Global, which saw its GGR rise slightly, coming in at 8.6 per cent (June: 8.4 per cent).

Slots remained the dominant segment for total games tracked, with a total percentage of 91.7, ahead of table games which stands at 3.5 per cent.

Instant win was up next with 1.8 per cent, slightly ahead of live casino’s 1.5 per cent, video poker’s 0.8 per cent and the 0.3 per cent shared between bingo/keno and lottery segments.

Mobile recorded the highest percentage of theoretical win generated per vertical with 71.5 per cent, followed by desktop at 27.3 per cent and tablet at 1.2 per cent.

The latest US Eilers-Fantini report examined data from Michigan, West Virginia, Pennsylvania, New Jersey and Connecticut across 28 online casino sites, tracking 60,627 games to represent around 64 per cent of the US market.

Canada round-up

Eilers & Krejcik’s Canadian report continues to provide statistics on the nation’s online casino industry, covering nine online casino sites to track 9,520 games across five provinces.

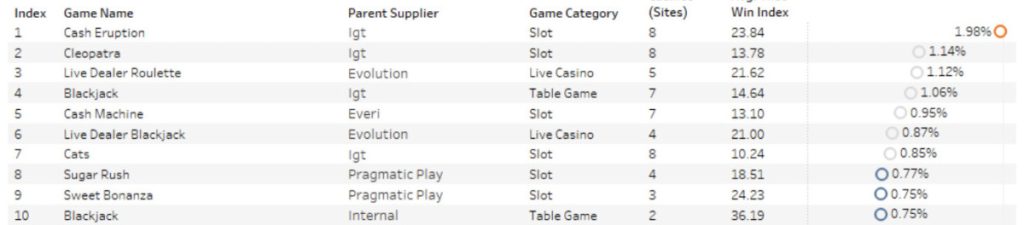

Once again, Cash Eruption led the way in Canada’s top games by GGR charts as well as the US, retaining its first place with a 1.98 per cent share of the total theoretical win (June: 1.95 per cent).

Again, similarly to the previous month, Cash Eruption was followed by another IGT slot, as Cleopatra came in second place with 1.14 per cent GGR share (June: 1.3 per cent), while Live Dealer Roulette from Evolution finished slightly behind to claim third with 1.12 per cent.

IGT’s Blackjack and Cash Machine by Everi rounded out the top five, with 1.06 and 0.95 per cent, respectively.

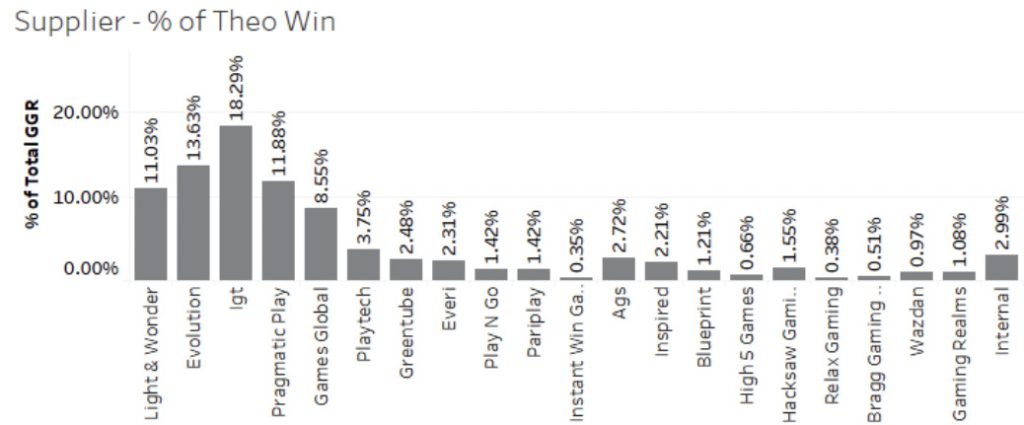

Signalling another strong month in Canada, IGT led the supplier charts with 18.29 per cent of theoretical win (June: 19.3 per cent).

The leading supplier was followed by Evolution with 13.63 per cent (June: 14.2 per cent), Pragmatic Play with 11.88 per cent (June: 12.09 per cent) and Light & Wonder with 11.03 per cent (June: 10.64 per cent).

If interested in learning more, subscribing, or participating in the Eilers-Fantini Online Game Performance Database reach out to Rick Eckert at [email protected].