IGT, Evolution and Light & Wonder each dropped points in August’s supplier charts as Eilers-Fantini revealed how igaming companies performed in the US and Canada.

The US charts saw each supplier gain a lower share of revenue compared to July’s reporting, while a number of new rankings dominated the new top games charts and the top three games by gross gaming revenue remained exactly the same.

Meanwhile, the Canadian Eilers-Fantini report saw Games Global overtake Pragmatic Play in the supplier charts for the first time as several of the studio’s slots breached the top 25 in several categories.

US stats

As aforementioned, the top slots by GGR charts witnessed robust performances from July’s top three games, as IGT’s slot Cash Eruption, Buffalo by Aristocrat and Blackjack, a table game also from IGT, kept their positions at the top of the table.

However, each title did drop in terms of GGR share, as Cash Eruption dropped from July’s 3.19% to 3.09%, Buffalo fell from 1.65% to 1.56% and Blackjack claimed 1.34%, after claiming 1.51% in July.

Rounding out the top five was another title from IGT, Prosperity Link Wan Shi Ru Yi, which burst into the top 10 as a new ranking to gain 1.23% of recorded GGR. Evolution’s Live Dealer Roulette also kept its place while dropping slightly in GGR share, coming in fifth with 1.07% (July: 1.08%).

From the top games per GGR, 16 were slot titles, three were table games and five were live casino titles, with no video poker games making the top 25 for the first time this year.

Gamecode’s recent Triple Stones slot release stormed its way to the top of the overall games charts as a new ranking, knocking Cash Eruption from its usual perch in July down to second place.

Meanwhile, the top 10 titles were shaken up completely as Blackjack from IGT rose from fourth to third, Live Dealer Lighting Roulette climbed from sixth to fourth and Capital Gains by AGS dropped from third to fifth.

Mining Loaded Pots from Games Global performed significantly well across August to rise from 38th place in July to sixth, while Light & Wonder’s 88 Fortunes, 3x Ultra Diamond by AGS – dropping from July’s fifth place finish – Prosperity Link Wan Shi Ru Yi and Doctor Reactive Mega Drop Low from Light & Wonder made up the rest of the top 10, in that order.

Moving onto the top slot charts, Triple Stones, Cash Eruption and Capital Gains made up the top three, respectively, and Mining Loaded Pots climbed from 28th place to fourth. Light & Wonder claimed fifth place with 88 Fortunes.

Overall, 14 suppliers were represented in the top slot charts, with Reel Play, Aristocrat, Greentube, Everi, High 5 Games, Inspired, White Hat Studios and Bragg Gaming Group all featuring at least once.

For the new game rankings, five of the top 10 were completely new rankings with August proving to be a strong month for recent releases. July saw only two new rankings within the top new games chart.

New ranking Triple Stones claimed top spot as expected, while Mining Loaded Pots climbed from 11th to second. 3x Ultra Diamond and new rankings Prosperity Link Wan Shi Ru Yi and Pacific Gold from ELK Studios made up the rest of the top five.

Light & Wonder’s Thundering Blaze, another new ranking, Mr Pigg E Bank and Dark Waters, Inspired’s Big Piggy Bank and Almighty Buffalo King from White Hat Studios, again a new ranking, rounded out the top 10 in that order.

Once again, each game that appeared in the top 25 new game rankings was a slot title, proving the vertical’s dominance in the US.

While Evolution, IGT and Light & Wonder kept their places as the top three brands in the supplier charts, each company saw their share of GGR drop.

Evolution fell from July’s 18.4% to 18.1%, IGT dropped for consecutive months from 17.4% to 17% and Light & Wonder fell to 13.3% from 13.4%.

This, in turn, saw smaller studios take a higher share of the GGR, with Games Global rising to 9.5% (July: 8.6%), Inspired climbing to 2.6% (July: 2.4%) and AGS reaching 4.8% (July: 4.5%).

As per usual, slots remained the dominant segment for total games tracked, with a total of 91.6%, ahead of table games which stands at 3.5%.

Instant win was next with 1.9%, slightly ahead of live casino’s 1.5%, video poker’s 0.9 per cent, lottery’s 0.3% and bingo/keno’s 0.2%.

Mobile recorded the highest percentage of theoretical win generated per vertical with 72.1%, followed by desktop at 26.9% and tablet at 1%.

The latest US Eilers-Fantini report examined data from Michigan, West Virginia, Pennsylvania, New Jersey and Connecticut across 28 online casino sites, tracking 62,875 games to represent around 64% of the US market.

Canada performance

Eilers & Krejcik’s Canadian report continues to provide statistics on the nation’s online casino industry, covering nine online casino sites to track 9,745 games across five provinces.

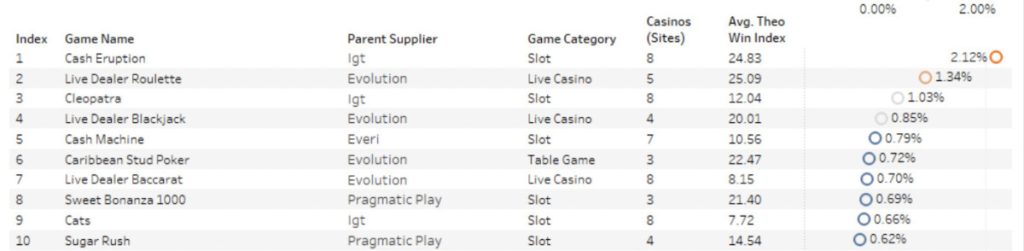

Similarly to the US, Cash Eruption kept its position atop Canada’s top games by GGR chart with 2.12% GGR share (July: 1.98%). However, Live Dealer Roulette from Evolution clinched second place with 1.34% GGR (July: 1.12%), leapfrogging Cleopatra which fell to third with 1.03% (July: 1.14%).

Evolution also took fourth place with Live Dealer Blackjack, while Everi’s Cash Machine remained in fifth place, with 0.85% and 0.79%, respectively.

While Canada’s top two suppliers stayed in the same positions as July, with IGT claiming top spot with 17.18% of theoretical win and Evolution taking second with 14.8%, the rest of the top five each took new positions on the supplier leaderboards.

Last month, Pragmatic Play (July: 11.88%) took third place, followed by Light & Wonder (July: 11.03) and Games Global (July: 8.55%) in fourth and fifth positions, respectively.

Yet, each supplier claimed a new spot in the charts as Games Global flew into third place with 11.64%, narrowly beating Light & Wonder’s 11.59%. Pragmatic Play fell into fifth place with 11.06%.

If interested in learning more, subscribing, or participating in the Eilers-Fantini Online Game Performance Database reach out to Rick Eckert at [email protected].