A rise in unlicensed gaming machines in Pennsylvania has led casino operators in the state to issue a petition to the Supreme Court, demanding a reassessment of the state’s taxation on slot machines, skill and hybrid games.

Filing the petition on 29 July, casinos such as Stadium Casino, Chester Downs, Rivers Philadelphia, Parx Casino Shippensburg, Wind Creek and Greenwood Gaming have requested “declaratory and injunctive relief” after considering the state’s lack of taxation on unlicensed operators and machines as “unconstitutional”.

The petition has named the Pennsylvania Department of Revenue, along with its Secretary Patrick M Browne, and the Pennsylvania Gaming Control Board as respondents, demanding that taxes be “uniform, upon the same class of subjects”.

Casinos have issued the petition after considering the Pennsylvania Gaming Act’s “substantial” ~50% tax on slot machine revenue as “unconstitutional” due to the lack of taxation on unlicensed gaming operators offering skill and hybrid games.

In 2023 alone, licensed operators contributed around $1.2bn in taxes through the ~50% slot machine revenue tax law, while unlicensed operators contributed 0% of their revenue from slots, skill or hybrid games.

The petition claims that since the Gaming Act was first introduced in 2004, over $20bn in revenue has been collected from slot machine taxes alone.

As a result of these findings, petitioners have claimed that the Gaming Act’s laws are being violated in numerous ways, stating that “there are numerous unlicensed entities in the Commonwealth operating devices that annually earn billions of dollars in revenue which, if earned by a licensed casino, would be taxed as slot machine revenue”.

Skill and hybrid slot machines

In 2017, amendments were made to Pennsylvania’s Gaming Act to change the definition of a slot machine to include skill and hybrid slot machines. Skill and hybrid slot machines implement at least a slight element of skill into a game of chance to be differentiated from a standard slot machine.

However, according to the petition, since the 2017 amendments to the Gaming Act, the operation of slot machines by unlicensed entities outside the framework of the Gaming Act has “expanded significantly”.

The petition noted: “Recent estimates suggest that approximately 67,000 skill and hybrid slot machines are operating in the Commonwealth.”

It is believed that several unlicensed establishments, whether they be bars, taverns, convenience stores, gas stations, pizza shops, laundromats or other venues, are offering skill and hybrid slot machines without distributing any taxes from their machines’ revenue, and without age-restriction and accessibility laws implemented through licences.

Referring to research from the American Gaming Association, the petition claimed that “these machines generate an estimated $1.9bn in revenue for unlicensed operators annually – close to the $2.5bn that Pennsylvania casinos earned from slot machines in 2023”.

The petition also refers to the violation of the Uniformity Clause of the Pennsylvania Constitution, which states that taxes be “uniform, upon the same class of subjects”.

To affirm this belief, the petition set out to compare the similarities between slot machines and skill and hybrid machines that can be found in many unlicensed establishments.

The petition named Banilla Games and Pace-O-Matic as two unlicensed skill and hybrid machine developers, delving into their cabinets to explain that their games are basically just slot machines with added mini-games with slight skill-based gameplay.

One game, Pace-O-Matic’s Pirates title, had its gameplay showcased in a video included in the petition. The footage shows standard slot gameplay with players relying on chance for the vast majority of their wins.

While skill-based gameplay does become implemented into these titles, the petition states that this is usually in the form of “time-consuming and difficult” memory games in which players are often required to remember lengthy sequences that take between 12 and 15 minutes to complete, just to win back around 105% of their original stake.

The petition claimed that “all ‘skill’ and ‘hybrid’ games function like this”, and again referred to research from the AGA that showed 65% of those familiar with skill and hybrid slot machines state that they “are no different from slot machines where wins are based on random chance, and that even a skilled player cannot reliably influence the outcome”.

Additionally, the petition noted that in 2023, Pennsylvania’s 1-800-GAMBLER hotline received 121 calls from individuals who identified ‘skill machines’ as their ‘most problematic gambling’ or ‘the gambling activity that the caller/subject has the most difficult time controlling’.

The hotline also received another 68 calls from individuals who identified ‘non Casino – slots’ (defined as unregulated slots) as their ‘most problematic gambling’.

Those 189 calls make up approximately 8% of all calls received by the hotline throughout 2023, which the petition refers to as “remarkable” considering unlicensed operators that offer these machines aren’t even required to advertise the responsible gambling hotline.

Furthermore, the rise of ‘parlours’ in Pennsylvania was noted by the petition, suggesting that at least two have opened up in the state. These parlours are essentially often unlicensed game rooms dedicated to operating skill or hybrid slot machines, without regulation as to who can access them or where they can be located.

One Pennsylvanian parlour, the Keystone Klub, was mentioned specifically in the petition as the facility’s website advertises its “game room to play skilled games”, where customers “don’t have to sit at the back of a gas station or a loud smoke-filled bar or casino”. Instead, they can play in the “game room”, complete with complimentary “beverages and snacks” and the “best payouts”.

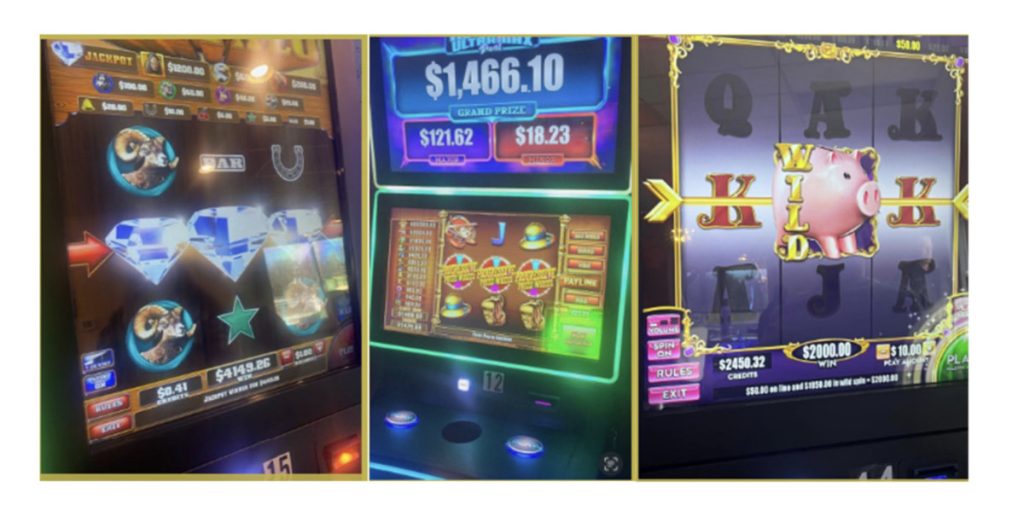

The Keystone Klub’s website advertises “recent winners” of “jackpot[s]” and “grand prize[s]”, showing thousands of dollars of winnings. The petition then included the following image to show the Klub’s offering, which looks similar to standard slot machines.

The petition explained: “To date, the Commonwealth Court, as well as Courts of Common Pleas, have held that unlicensed entities are not prohibited from operating these skill and hybrid slot machines because the machines do not constitute ‘gambling devices’ or ‘slot machines’ under Section 5513 of the Crimes Code.

“In addition, the Commonwealth Court has held that the unlicensed operation of skill and hybrid slot machines is not subject to the Gaming Act’s regulatory framework.

“As a practical matter, these decisions effectively conclude that unlicensed operators of skill and hybrid slot machines are also not subject to the Gaming Act’s slot machine tax.”

Petitioners have underlined that they “vigorously disagree” with those decisions, leading to this very petition which asks for relief on four counts.

Declaratory and injunctive relief

Firstly, on Count I, the petition demands a declaration from the respondents that the taxation laws on slot machines are constitutional. Count II, meanwhile, seeks a corresponding permanent injunction requiring respondents to collect taxes from revenue generated from all slot machines in the state, including those operated by unlicensed entities.

Alternatively, the petitioners asked the Supreme Court to enjoin respondents from collecting slot machine taxes altogether.

The petition read: “To avoid any immediate and disruptive effects on the Commonwealth’s tax revenue, Petitioners request that this Court stay such an injunction for 120 days to allow the General Assembly to correct the unconstitutionality of the slot machine taxes.

“To be clear, Petitioners do not seek to pay no taxes on revenue generated from slot machines; rather, they seek parity in the burden of slot machine taxes, as required by the Uniformity Clause.”

Both Counts III and IV included similar aspects of Counts I and II, however, they referred to skill and hybrid machines rather than slot machines.